Make a Difference

Now, more than ever, your support makes an immediate difference. As a non-profit organization, your generosity ensures our animals are safe and well cared for through this crisis and beyond.

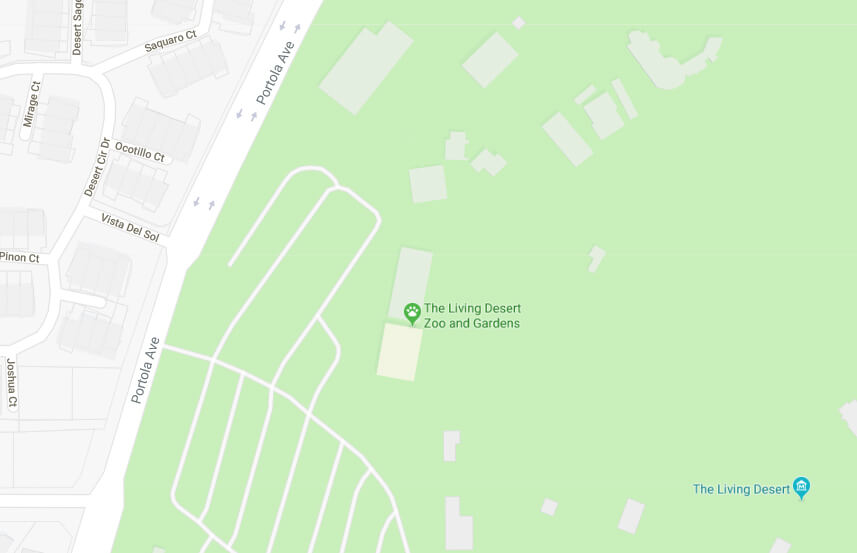

For over 50 years, The Living Desert has been a leader in the conservation of the world’s deserts. As a 501(c)3 non-profit organization, we rely on the generosity of donors to sustain our operations. Your gift to the Zoo will enable us to continue providing the highest level of care to our animals, educating the next generation about the world’s deserts, and inspiring our guests to care for the world’s wildlife and wild places.

Champions

of Conservation

Want to make an even bigger impact? Join our Champions of Conservation monthly giving program. Your gift provides resources needed monthly to feed our animals, provide educational outreach opportunities, and support worldwide conservation efforts.

Memorial

and Tributes

Honor a loved one and show your support and appreciation for desert wildlife. Your gift will serve as a loving tribute and provide a lasting contribution to The Living Desert.

Memorial gifts can be made in memory of a loved one or Tribute gifts can be made in recognition of a milestone or accomplishment.

Planned Giving

Create a legacy of your dedication to the conservation work and education programs of The Living Desert leaving a gift in your will or trust. Planned giving through a charitable bequest is one of the easiest gifts to make.

The Heritage

Society

Align with similar interests. Join The Heritage Society and be part of a select group who have stated their intentions to leave a deferred gift in their estate to The Living Desert.

If you are considering a gift of any size and would like more information, please contact us at development@livingdesert.org or call (760) 346-5694.

Living Legacy

Endowment

Endowment fund donations are structured so that the principal amount is kept intact while the investment income is available for use by The Living Desert, thus sustaining the Zoo and Gardens for the future. If you’d like to learn more about gifts of $5,000 or more or receive a briefing and tour of The Living Desert, please contact us at development@livingdesert.org, or call (760) 346-5694.

The Living Desert is a 501(c)3 non-profit organization. (EIN 95-3385354).